The 2025 Federal Budget: What It Means for Housing, Cost of Living, and Infrastructure

As the Australian government unveils its 2025 Federal Budget, all eyes are on Treasurer Jim Chalmers as he lays out the financial roadmap for the year ahead. With cost-of-living pressures mounting and the next federal election looming, the budget aims to provide relief to households while investing in long-te

RBA Rate Cut: What It Means for You & How Much You Could Save!

The Reserve Bank of Australia (RBA) has officially cut interest rates, offering much-needed relief to homeowners and investors. With the cash rate now reduced to 4.1%, this decision is set to impact mortgage repayments, home affordability, and the broader economy. But how much can you really save, and what sh

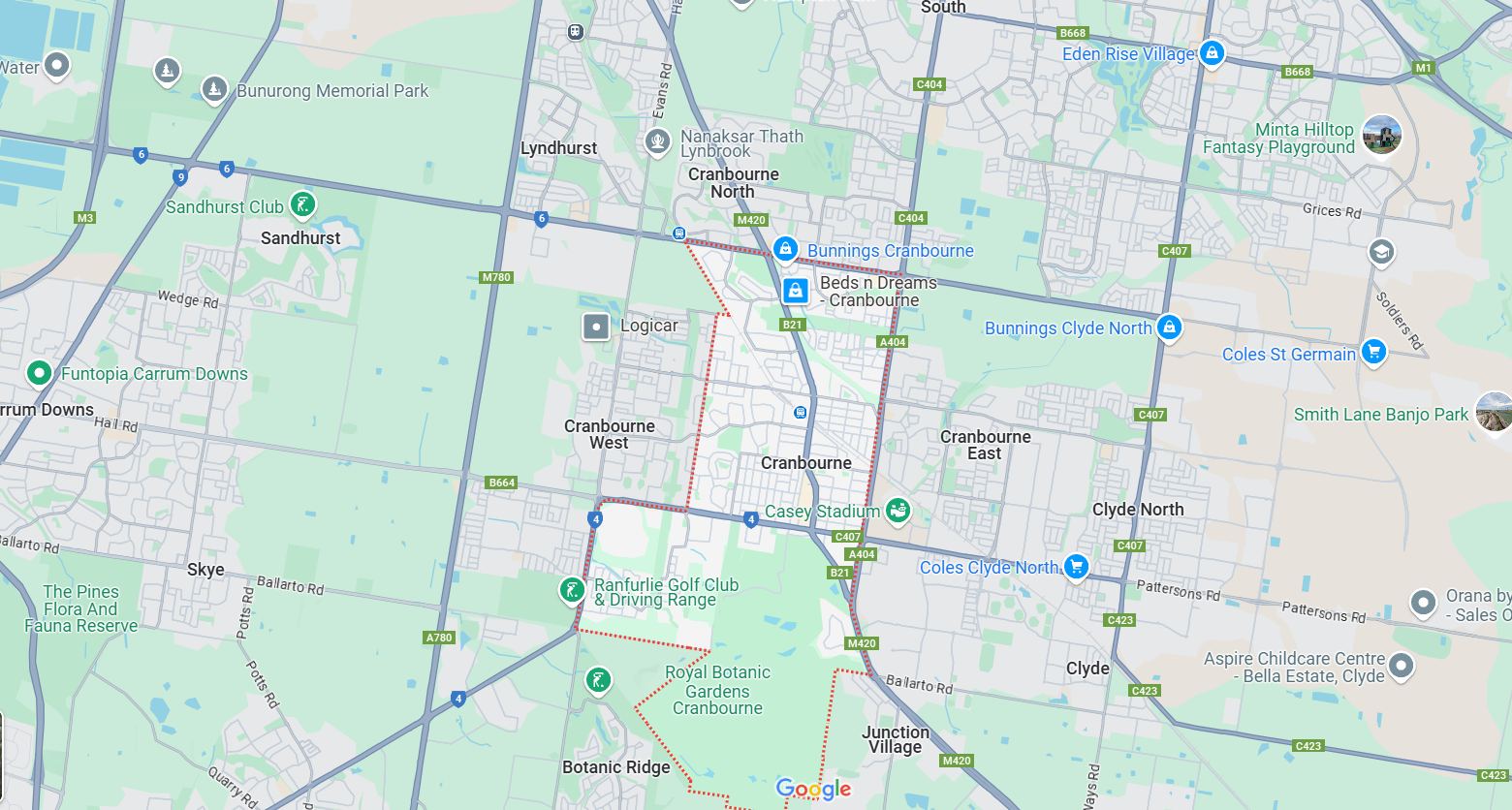

Best Real Estate Agents in Cranbourne East, Cranbourne West, and Cranbourne North

Are you searching for the best real estate agent in Cranbourne East, Cranbourne West, or Cranbourne North? Whether you’re buying, selling, renting, or managing a property, working with a professional real estate agent can help you navigate the market with confidence. At BestPropertyAgent.com.au, we connect

How Trump’s New Tariffs Could Impact Australian House Prices: What You Need to Know

The re-election of Donald Trump as U.S. President has sparked renewed discussions about his trade policies, particularly regarding tariffs. As these policies could have far-reaching consequences for the global economy, many in the Australian real estate market are wondering how Trump’s tariffs might inf

2025 Australian Property Market: Trends, Insights, and Opportunities for You

As we move into 2025, the Australian property market is showing clear signs of transition. For property buyers, sellers, and investors, staying updated on the latest trends is key to making informed decisions. Whether you’re looking to sell your home, invest in real estate, or secure your first property, un

What Could Home Loan Rates Look Like in 2025?

As we approach the close of 2024, homeowners and prospective buyers across Australia are asking, “What could home loan rates look like in 2025?” Whether you’re thinking of securing a new home loan, refinancing, or entering the property market, understanding the future of interest rates is cr

Melbourne Real Estate Update: Top Suburbs with Falling House Prices in 2024 – What Buyers and Sellers Need to Know

If you’re considering buying or selling a property in Melbourne, you may find the current market conditions surprising – and potentially favorable. Amid high interest rates, an influx of homes for sale, and recent tax changes affecting investments, many of Melbourne’s most sought-after suburbs are seein

A New Era in Australian Real Estate: What to Expect in 2025

As we look ahead to 2025, the Australian real estate landscape is poised for substantial change. With shifting demographics, economic pressures, and government interventions, a seismic shift in the property market is on the horizon. Recent insights from the 2025 McGrath Report reveal critical trends that will

Who Benefits from Blocking RBA Reform?

The recent stalling of the proposal to establish an independent monetary policy committee within the Reserve Bank of Australia (RBA) has sparked debate, and it’s worth considering who stands to gain. Experts believe it’s a loss for everyday Australians and a win for the RBA. Over recent months, the RB

RBA Holds Interest Rates Steady: What This Means for Australian Homeowners

In a decision that leaves many Australian homeowners waiting, the Reserve Bank of Australia (RBA) has opted to maintain the cash rate at 4.35% for the seventh month in a row. This continued pause on interest rates delays the anticipated cuts that many have been hoping for. This decision comes in the wake of t