Australian Mortgage Rates Update: Key Changes This Week

This week, Australian mortgage holders and homebuyers experienced a range of changes in home loan rates. According to Canstar, the mortgage landscape is quite mixed, with some banks increasing their rates while others have decided to cut them.

Rate Adjustments: What You Need to Know

Rate Increases:

- Two lenders have raised their variable home loan rates for both owner-occupiers and investors. The average increase is 0.07%.

- Additionally, the Bank of Sydney has increased its fixed rates for six different loan products by an average of 0.23%.

Rate Cuts:

- Conversely, three lenders have cut their variable rates for 24 different home loan products by an average of 0.08%.

- More significantly, six lenders have reduced their variable rates across 116 different products by an average of 0.47%.

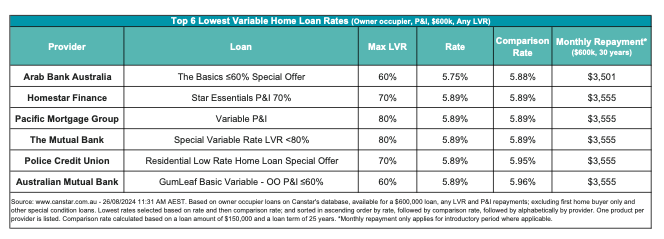

- Among these changes, Abal Banking stands out by offering the lowest variable rate of 5.75%. According to Canstar’s database, there are still 22 other rates below this benchmark, providing competitive options for borrowers.

Fixed Rate Developments

Sally Tindall, Director of Data Insights at Canstar, described the week as “eventful” due to significant cuts in fixed rates. Major banks like the Commonwealth Bank of Australia (CBA) and Westpac have lowered their fixed rates. Westpac now offers the lowest fixed rates among the big four banks for terms ranging from one to five years. Meanwhile, CBA has the joint lowest three-year fixed rate at 5.89%.

Tindall attributes these reductions to the declining cost of wholesale funding as central banks around the world start to lower their official rates. However, she advises caution: “Fixed rates are still adjusting and are likely to continue falling,” she said.

CBA’s Strategy and Market Impact

In a surprising move, CBA has reduced its variable mortgage rates, but this change applies only to new customers. Tindall pointed out that this strategy is designed to attract new business while keeping the bank competitive. “Existing CBA customers should use this opportunity to negotiate a better rate for themselves,” she advised.

This move by CBA is likely to influence the broader mortgage market. “CBA’s decision to lower its rates is a sign of the intense competition among lenders,” Tindall noted. She expects that other banks may follow suit and reconsider their rates for new customers as a result.

What Should You Do Next?

If you’re considering selling your home or looking for the best property agents to help with your real estate needs, our six-step guide to selling your home fast can be a valuable resource. It will help you navigate the process and achieve a quick and successful sale. Additionally, if you want to find top property agents near you or check your property’s value, click here to get started.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any decisions regarding home loans and property transactions.

Source : brokernews

We’d love to hear your thoughts on these recent changes. Share your comments below and stay updated with our latest posts for more insights and tips!

Leave a Reply